Regulatory compliance has become the silent profit killer across North American businesses.

Organizations in heavily regulated industries, e.g., healthcare, finance, and insurance, face substantial financial and reputational risks that have only intensified with new regulations rolling out quarterly. In fact, in the past decade, regulatory changes have skyrocketed, with financial firms now tracking an average of 234 new regulatory alerts per day.

That’s a lot to keep track of, and falling behind isn’t an option as the cost of non-compliance now runs nearly three times higher than the cost of staying compliant. To put it in perspective, companies spend about $5.5 million annually on compliance versus $14.8 million dealing with non-compliance issues. And those figures don’t even capture the full fallout of lost customers, damaged reputation, and operational disruptions.

In terms of enforcement, regulators have shown they mean business with the SEC collecting a record $8.2 billion in fines in 2024, a 66% jump from the prior year. And it’s clear where they’re getting all that money. Just look online, and high-profile cautionary tales pop up everywhere.

These incidents trace back to the same root problems, which are poor process visibility, weak documentation, and missing controls. Yet despite these astronomical costs, 76% of compliance managers still manually scan regulatory websites to track changes, and 60% manage compliance using spreadsheets. These traditional compliance methods do work to some extent, and have served organizations relatively well in past years, but it’s clear they struggle to keep up with this complexity. The good news is that modern process intelligence platforms are changing the game. By mapping, monitoring, and simulating compliance processes in real-time, iGrafx Process360 Live gives teams a proactive way to ensure every workflow stays in line with the rules.

In the pages that follow, we’ll dig into the core regulations facing North American companies, e.g., HIPAA, SOX, PPACA, MHPAEA, COBRA, OSHA, ISO 9001, EPA, and Basel III. We’ll explore real-world examples of compliance failures and their costs, then demonstrate how iGrafx transforms compliance from a reactive scramble into a strategic advantage.

The Compliance Landscape in North America

Here’s an overview of the regulatory requirements in a few major sectors:

Healthcare: Safeguarding Patients and Data

Healthcare ranks among the most heavily regulated sectors, which makes sense given the highly sensitive services and data involved. The sector faces multiple layers of regulation:

HIPAA (Health Insurance Portability and Accountability Act)

The federal Health Insurance Portability and Accountability Act (HIPAA) mandates rigorous protection of personal health information (PHI) nationwide. The requirements cover everything from data security to patient rights, and violations can cost up to $2.13 million per incident. As if federal regulations weren’t challenging enough, companies must also account for state-level laws that vary widely and change constantly.

Take Texas’s Medical Records Privacy Act (HB 300). It extends privacy requirements beyond HIPAA’s traditional scope, forcing business associates, schools, and IT providers to follow HIPAA-level rules when handling Texan health data. The state demands faster employee training (90 days of hire), 15-day breach response requirements, and imposes $250,000 penalties (plus $100 per record, per day) on top of federal HIPAA fines.

On the West Coast, California’s Consumer Privacy Act (CCPA) (and its updated CPRA) imposes strict rules on any company handling resident data with fines of up to $7,500 per intentional violation.

In short, a hospital system operating in multiple states must juggle federal HIPAA plus a patchwork of state laws, each with its own requirements.

PPACA (Patient Protection and Affordable Care Act)

The Patient Protection and Affordable Care Act (PPACA), better known as the Affordable Care Act, added further layers of compliance for healthcare organizations and insurers. Hospitals now report quality metrics and face financial penalties for issues like avoidable readmissions, while health plans must cover “essential health benefits” and meet insurance marketplace regulations.

MHPAEA (Mental Health Parity and Addiction Equity Act)

The Mental Health Parity and Addiction Equity Act requires insurers to cover mental health services on par with medical and surgical benefits. Violations carry serious consequences. Over the past few years, states have levied more than $31 million in fines and corrective payments against insurers for parity violations.

COBRA (Consolidated Omnibus Budget Reconciliation Act)

COBRA compels employers and insurers to offer continued health coverage to former employees. COBRA administration is notoriously complex (with tight notice deadlines and payment rules), and failure can mean tax penalties or employee lawsuits.

Financial Services: Ensuring Transparency and Stability

In finance and banking, compliance is nothing new – but it’s getting tougher by the year.

SOX (Sarbanes-Oxley Act)

Public financial companies operate under the strict requirements of the Sarbanes-Oxley Act (SOX), which demands rigorous internal controls and accurate financial reporting to prevent corporate fraud. SOX compliance requires painstaking documentation of processes and controls.

CEOs and CFOs must personally attest to the accuracy of financial reports, facing penalties for falsehoods. It’s a heavy burden, but ignoring it can lead to restatements, stock crashes, or worse. The high-profile accounting scandals that birthed SOX have made regulators unforgiving of sloppy controls.

Basel III

Banks and large financial institutions also contend with global risk regulations like Basel III. U.S. banking regulators (the Federal Reserve, FDIC, etc.) have implemented Basel III standards on capital adequacy, stress testing, and liquidity to ensure banks can weather shocks. Compliance means constantly monitoring risk models and ratios – falling short can trigger enforcement actions or restrictions on operations.

Manufacturing & Energy: Safety and Sustainability Requirements

Manufacturers, energy companies, and other industrial firms operate under a broad spectrum of safety and environmental regulations, including:

OSHA (Occupational Safety and Health Administration)

The Occupational Safety and Health Administration (OSHA) sets strict workplace safety standards, everything from machine guarding to hazard communication, to protect employees on the job.

If an accident happens or an inspection finds serious violations, fines can escalate quickly. Individual OSHA penalties can run over $16,131 per serious violation, and willful or repeat violations carry even higher fines (plus potential criminal liability if negligence is proven in a fatality).

It’s not uncommon for a serious incident to result in hundreds of thousands of dollars in fines or more. Beyond the dollar figures, these incidents often halt production, spark lawsuits, and devastate morale.

EPA (Environmental Protection Agency)

The Environmental Protection Agency (EPA) enforces a host of laws like the Clean Air Act, Clean Water Act, hazardous waste (RCRA) regulations, and more to curb pollution and ensure environmental safety.

Noncompliance can lead to costly cleanup orders and legal settlements. Just recently, Utica Resource Operating LLC was hit with a $1 million Clean Air Act penalty and is required to fund $1.9 million in pollution-control upgrades.

In 2024 alone, the EPA concluded 1,851 cases totaling $1.7 billion in penalties across big and small firms.

Penalties aside, companies may be forced to invest in new pollution controls or even suspend operations until issues are fixed. Environmental violations also inflict reputational harm as today’s investors and customers are highly attuned to sustainability.

ISO 9001

Finally, many U.S. manufacturers adhere to industry standards like ISO 9001 (for quality management) to stay competitive. While ISO 9001 certification is voluntary, it’s often essential for doing business with certain clients or sectors.

It requires documenting and following consistent processes to ensure product quality. Lack of compliance with such standards can result in product defects or recalls (which then might invoke regulatory scrutiny from agencies like the FDA or Consumer Product Safety Commission, depending on the industry).

Why “Set-and-Forget” Tools and Manual Compliance Aren’t Enough

Here are a few reasons legacy tools fall short:

Siloed, Static Information

For one, static documents can quickly fall out of date. Laws and regulations evolve, but a printed procedure binder or a Visio process map sitting on someone’s hard drive won’t be flagged for update when, say, a new OSHA rule or California privacy amendment comes into effect. This leads to information blind spots and inconsistencies.

Many organizations discover these compliance gaps only when something goes wrong, an audit finds a control not being followed, or an incident reveals that an SOP was never updated. Modern regulations demand dynamic, real-time documentation, which static files simply can’t provide.

Lack of Visibility, Poor Version Control, and Audit Trail

Compliance processes often cut across departments and systems. Consider a seemingly simple task like ensuring COBRA notifications are sent to departing employees. HR might own the offboarding checklist, a third-party administrator handles the notices, and Payroll must update benefits status; if these steps aren’t mapped out and tracked, it’s easy to drop the ball.

Manual tracking (think email reminders or a shared spreadsheet) relies on humans to remember every step, which is risky and inefficient. And when it comes to proving compliance, teams end up scrambling through email archives and file servers to pull together evidence for auditors.

Inability to Adapt Quickly

Manual compliance checks happen too late. Monthly or quarterly reviews catch violations after they’ve occurred, when the damage is already done and regulators are likely to impose maximum penalties for ongoing non-compliance.

Imagine a new rule goes into effect next month. With spreadsheets, someone must identify every affected process across the business, update each document, hope they didn’t miss any, and manually communicate changes to all teams. It’s slow and prone to mistakes. Legacy tools also make it hard to test or simulate the impact of changes.

Many companies are essentially flying blind, implementing process updates without fully understanding how they’ll ripple through operations. This is where modern platforms shine. As we’ll see, they allow you to model and simulate changes virtually before rolling them out, ensuring you catch issues in advance.

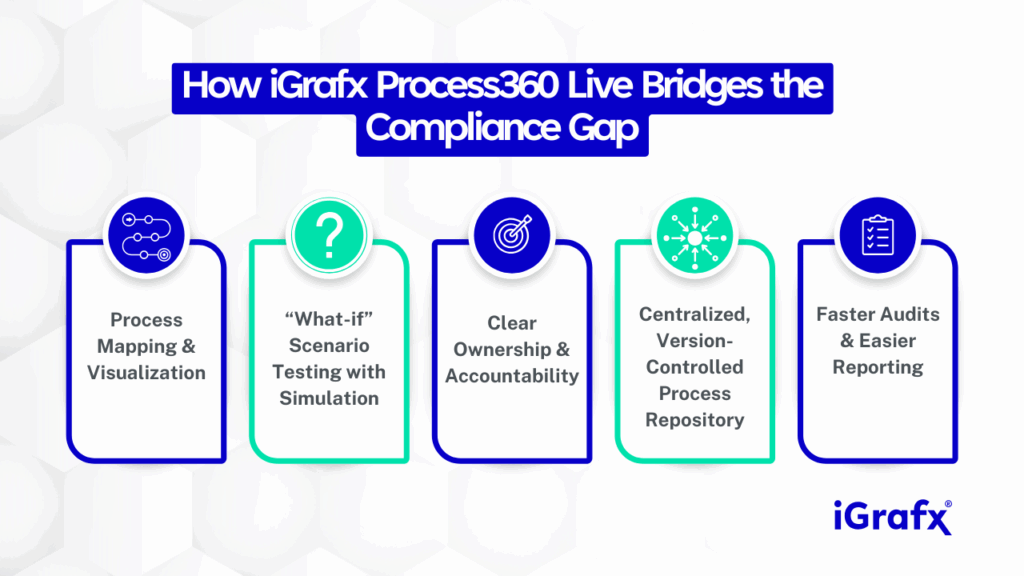

How iGrafx Process360 Live Bridges the Compliance Gap

Let’s break down how a process intelligence platform like iGrafx Process360 Live addresses compliance pain points:

Process Mapping and Visualization

You can map out each business process visually (e.g., using industry-standard BPMN notation) and capture rich details about responsibilities, controls, and linked policies, creating a single source of truth that everyone from front-line employees to internal auditors can access.

This provides Process Intelligence, a deep understanding of how the work flows, and where compliance obligations intersect. For example, a hospital can map out where PHI (protected health info) flows through each step of a patient intake process, and highlight control points where data must be encrypted or consent obtained. Often, this exercise alone highlights where a rogue workaround or duplicate step is causing a compliance risk.

“What-If” Scenario Testing with Simulation

With iGrafx Process360 Live, organizations can create a digital twin to run “what-if” simulations and predictive analytics on their processes. This is a game-changer for adapting to regulatory change.

For example, a global bank adapting to Basel III risk-reporting rules can use iGrafx Process360 Live to simulate a new second-level approval for high-value loans or an added data-quality check in its risk model, seeing how cycle time, queue length, and other metrics shift across the entire process, so any potential bottlenecks may be addressed before any policy goes live.

Clear Ownership and Accountability

In modeling processes, iGrafx enables you to define roles and responsibilities for each step. This brings granular attribution of who is responsible for what, which is key for compliance.

Each role comes with specific permissions, and you can finely control who can view or edit each item. This role-based permission system protects sensitive compliance content and prevents unauthorized changes.

Every edit to a process or document creates a new version in the repository, maintaining a full history of changes. You always know who changed what and when. This level of version control and accountability is a boon during audits, as it’s easy to demonstrate your governance process.

Centralized, Version-Controlled Process Repository

Instead of policies scattered across Word docs and network folders, iGrafx provides a single source of truth for all your process documentation and controls.

Every process, whether it’s a HIPAA-compliant patient data flow or a Basel III risk reporting procedure, can live in one governed central repository, complete with revision history. This means all employees are referencing the same up-to-date procedure at all times.

Faster Audits and Easier Reporting

Come audit time (whether by internal audit, external regulators, or certifying bodies), iGrafx shines in making documentation and evidence readily available. All your processes are documented (e.g., in BPMN 2.0, a globally recognized process notation), lifecycle managed (e.g., you know which are approved), and contain an audit trail. You may easily generate ‘Process Narrative’ documentation and other reports on processes.

Process360 Live can also quickly generate reports mapping regulations to the specific controls and process steps that satisfy them. Assembling audit evidence is largely an export command, not a frantic search through binders.

The Proven ROI of Intelligent Compliance and Risk Management

Process intelligence delivers measurable returns in five core areas.

- Direct cost savings. Save time and money with more efficient audit-prep cycles through consolidated and version-controlled documentation.

- Risk mitigation. Identifying risks and controls for monitoring helps companies avoid multimillion-dollar fines and consent orders.

- Productivity gains. Get more done with the ability to model and link risks, controls, and regulations to processes.

- Accuracy improvements. End-to-end process visibility reduces compliance-related errors by up slashing rework and exception handling.

We also can’t ignore the positive side-effect of all this: operational efficiency. Many companies find that by tightening their compliance processes, they also uncover ways to streamline operations. Redundant steps get eliminated, resources are better allocated, and performance improves all while ‘staying within the lines.’ It turns out that doing things the right way, the first time, with full visibility, is simply good business.

Ready to start proactively managing compliance? Contact iGrafx or book a personalized demo today to discover how Process360 Live can empower your compliance and risk teams and ensure your business stays confidently on the right side of regulations.